35+ Debt payoff credit score calculator

Credit card debt was on the upswing again in 2015 and if spending continues at its current rater debt could approach the levels seen just before the bottom fell out of the economy in the 2008 Great Recession. A Helpful Guide to Getting Out of Debt.

Checking Credit Scores Is Easy With These 8 Tools Geekflare

Financing Type Upfront Fees APR Benefits Approval Time Type.

. The debt-to-income ratio must be less than 40 for single applications and 35 for joint applicants. Jul 31 2026. Payment history accounts for roughly 35 of your score.

If you have a low credit score pay off all your debt dont miss any bills and wait until your credit score disappears before trying to buy a house. Flexible terms does not require collateral. Personal loans with good to excellent credit.

Credit card payoff calculator. Paying off an installment loan as agreed over time does build credit. Just one 30-day late payment can hurt your credit scores.

And if you make timely payments for five or more years on an installment loan thats a lot of goodwill for your credit score. That means if you make 36000 a year the car price shouldnt exceed 12600. Credit card debt soared past the 900 billion mark in the fourth quarter of 2015 with the average US.

The company requires a credit score of 600 to qualify offers loan amounts of 2000 - 36500 and has an APR range of 799 - 3599. People use personal loans for many different reasonsfrom buying an RV to paying off medical billsbut consolidating your credit card debt may be one of the most popular uses. Universal Credit is an online lending platform that offers personal loans between 1000 and 50000 through its partners.

Households find themselves buried in debt. Use the tips below as a general guide to managing your credit in a. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate.

You could pay off debt and see your credit score drop if youre not also paying other bills on time or keeping your credit card balances low. If you have 10000 in debt and 20000 in available credit for instance your credit utilization ratio is 50 percent. According to CNN Money the average indebted household in the United States owes more than 15000 in credit card debtThe average mortgage debt stands at roughly 153000 and the average student loan debt is more than 32000.

Upstart Debt consolidation loans through Upstart are the best if you need a large loan. Choose your credit score range to see your debt consolidation options including personal loans. Your payment history accounts for 35.

By taking the. In part thats because 35 of your credit score is based on timely payments. The minimum credit score for refinancing is 620 but a higher credit score will grant you more competitive rates.

Credit Card Payoff Calculator. Payment history is the most influential factor in calculating your credit score accounting for roughly 35 of your FICO Score the score used by most lendersAny late payment reported to the credit bureaus will have a swift and significant effect on credit scores and will remain on your credit report for. Youll see typical annual percentage rate ranges offered by lenders along with.

Payment history is 35 percent of your credit score so making on-time payments will increase your score. A minimum credit score of 600 is required along with a minimum credit history of three years. Just quickly confirm your identity and youll get access to your latest credit score based on your TransUnion credit report.

You do not need a credit score to. These loans have dollar amounts of 1000 - 50000 with typical APRs of 535 - 3599. Repayment terms range from 36 to 60 monthsor three to five years.

Mortgage Payoff Calculator Cost of Living Calculator. Youll then be able to check your score for free at any time on any device including your smart phone and tablet. Itll be much easier for you to get a mortgage with no.

Types of Credit and Length of Credit History. If you only have revolving credit like credit cards adding a personal loan for debt. Whether youre paying cash leasing or financing a car your upper spending limit really shouldnt be a penny more than 35 of your gross annual income.

Credit Cards. Heres How Much Car You Can Afford Follow the 35 Rule. You can check your credit score for free in less than two minutes on WalletHub the first site with free daily credit score updates.

Fico Score Vs Credit Score Differences 4 Tools To Check Geekflare

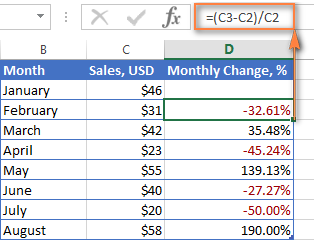

How To Calculate Percentage In Excel Percent Formula Examples

Best Personal Loans In Springfield Top Lenders Of 2022 Moneygeek Com

Fico Score Vs Credit Score Differences 4 Tools To Check Geekflare

Bankse Bankse In Twitter

Tm2134804d1 Ex99 1img036 Jpg

Credit Score Monitoring Is Easy With These 7 Solutions Geekflare

Grocery Budget Calculator Is Your Grocery Budget Out Of Control

Best Personal Loans In Cleveland Oh Top Lenders Of 2022 Moneygeek Com

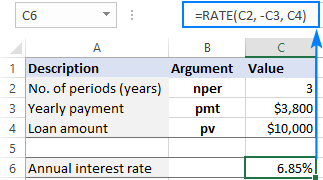

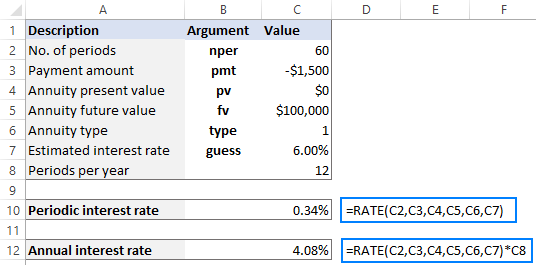

Using Rate Function In Excel To Calculate Interest Rate

Using Rate Function In Excel To Calculate Interest Rate

Employee Onboarding Best Practices Kpa

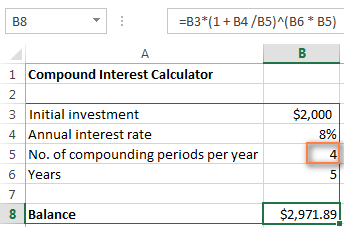

Compound Interest Formula And Calculator For Excel

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

Free Printable Debt Payoff Coloring Page Credit Card Debt Payoff Credit Card Tracker Credit Card Interest

Deals On Twitter Planejamento Financeiro Objetivos Financeiros Lista De Convidados De Casamento

Top 100 Personal Finance Blogs Top Finance Bloggers 2022